Do you sometimes find yourself thinking, “Had I known then what I know now”? This article could have been penned, “A Letter to My Younger Self”. I am almost two decades removed from 30. Although I made a conscious effort to manage my finances at an early age, my approach could have been better. This is why you need this list of 20 financial to do’s before you hit 30.

My former boss told me, “If you do not have at least 50,000 Pesos saved right now, you will be in trouble.”

That was back in 1991. I was 24 years old with a year of work under my belt. What is the value of 50,000 Pesos today? In 1991, I could get a full tank of gas with 100 Pesos. Today, 500 Pesos may not even get me a half tank of gas.

If you are 30 or approaching your third decade of life, you are reaching a stage where turning point decisions have to be made. If you are a regular employee, your economic viability will start to decline the closer you get to 35.

If you have not been promoted or given a significant pay increase, you may wish to ask your company about its career planning program, look for another job or consider entrepreneurship.

Life is full of “ifs” and that is why you should not depend on anyone else except the one person you can or should trust: YOU.

Here are 20 financial to do’s you should consider right now:

Table of Contents

Toggle1. Focus on Financial Independence

Whether you have a well-paying regular office job or a successful enterprise, know one thing: Nothing is certain.

Your job could be gone tomorrow. You could lose your biggest client in a heartbeat. I know where I come from because I’ve experienced both.

Over the next three years, I worked harder and smarter to regain financial footing.

If you are successful in your career, do not rest on your laurels. Find ways to improve on your success, create new wealth and stabilize your career. If you do not want to go hungry, never lose your hunger to find financial independence.

2. Set Your Financial Goals

How much money do you want to have at the end of 2016? Goal setting is one of the most powerful tools in generating productivity.

Setting your financial goals is no different than other goals you have set in your life. It requires strategic thought, planning, and precise execution. You must display the values of commitment, dedication, and discipline.

Whether you hit your financial goal or not is not the point. Setting financial goals puts you on the road to becoming more responsible with the money you earn.

3. Get Your Priorities in Order

When I lost my job in 1992, I only had 11,000 Pesos in my savings account.

Where did it all go? I blew my money on drinks, late night outs, and juvenile behavior. The wake-up call that I did not do a good job managing my income was more painful than waking up with no job to go to.

I used my 11,000 Pesos to fund computer studies. When I found a new job a year later, I had learned a valuable lesson and started saving my money.

It’s part of growing up to indulge in foolish behavior. But if you don’t have your wake-up call before you’re 30, you may wake one day and find your life up in smoke.

4. Cut Down on the Credit Cards

Do you remember the day you received your first credit card? Do you remember the power surging through your veins? Like you could buy anything you want?

So you buy and pay the minimum amount every month and the vicious cycle of buying on credit and paying on installment continues. Until the time comes that the minimum has grown larger than your entire life savings.

Welcome to the Debt Trap.

Credit cards give you a false sense of financial security. What a credit card does is expose your financial insecurity.

Does owning a credit card have merit? Yes because it gives you credit rating and provides convenience when you have no cash on you. Having a credit card for these reasons is good.

The key is to control credit spending. Moderate your greed; pay cash if you can and buy only things you need not want.

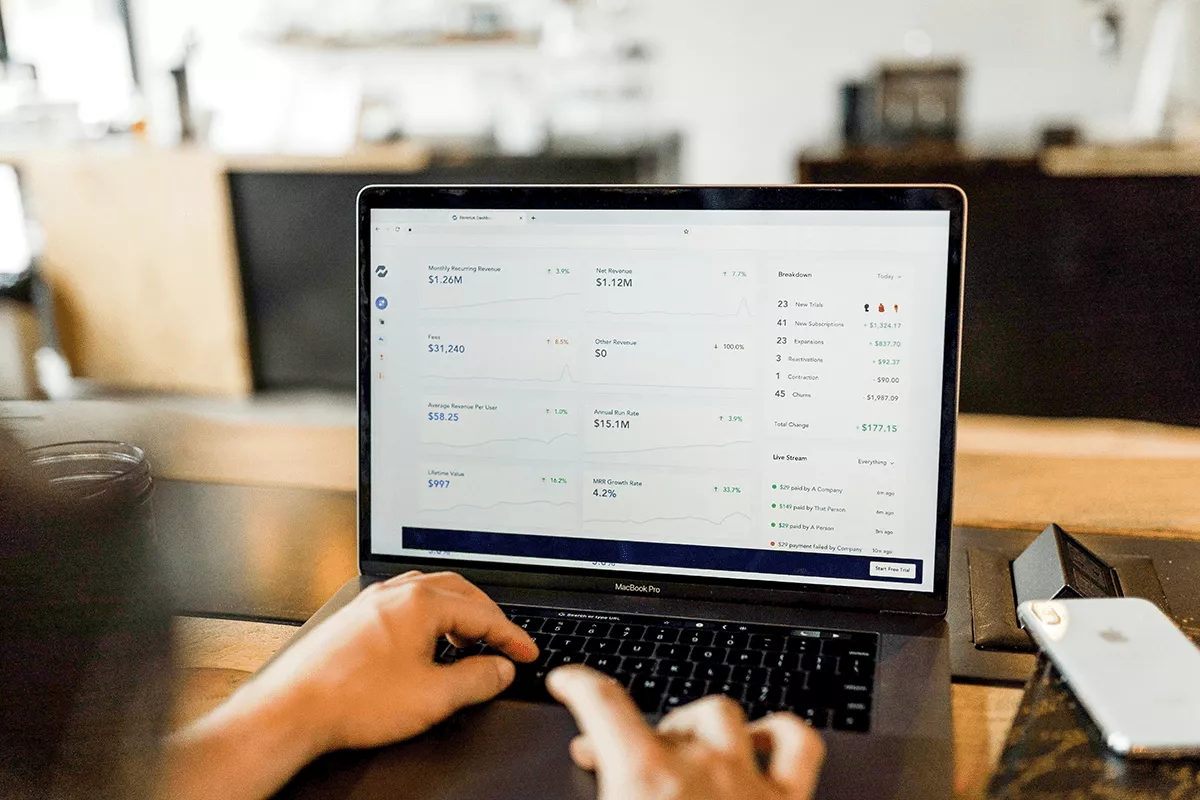

5. Keep Track of Your Cash Flow

A cash flow statement is a simple but highly effective way to keep track of your finances. It consists of the following entries:

- Cash Inflow – Your sources of income every month.

- Cash Outflow – Your summary of expenses every month that must be paid out of your cash inflow.

- Net Cash Flow – The ending balance once you deduct Cash Outflow from Cash Inflow. You could have a negative or positive cash flow.

I would advise you to start taking financial control of your affairs with the following statements:

- Projected Income Statement – Prepare at the start of the month consisting your expected income and expenses.

- Actual Income Statement – Prepare at the end of the month consisting your actual income and expenses. Compare the projected versus the actual to see how efficient you are in managing your income.

- Cash Flow Statement – It should reflect the income and expense items on your income statement. Your cash flow statement also functions as a cash disbursement schedule.

Your income statement reflects credit card payments and amortizations if any. It does not take much time to prepare these statements. And having them allows you to keep track of your income and assure the prompt payment of obligations.

6. Follow the 80-20 Rule

This is a simple rule that was shared to me by a close friend who also happens to be my accountant.

He told me that once I have paid off my bills, save 80% of your remaining income. The 20% can be set aside in a separate fund for my son’s education, emergencies or retirement.

Of the 80%, I can choose to keep it in savings or invest it in other placements that offer better returns.

The bottom-line is: Have savings! If you have money saved up, you will have more financial flexibility to grow your wealth.

Ricky Sare is a writer, an entrepreneur, and a member of Tycoon Philippines editorial team. He is also the owner of Benchmark Global Management Solutions, Inc., a BPO company located at Makati.