Ask most experts, and they’ll say it’s a sound financial strategy to own assets that generate income as opposed to assets that mostly yield expenses. This appropriately applies to real estate, as property purchase to be rented out generates more consistent amount of income compared to when it is limited to personal use or kept idle.

However, having property to rent out does not immediately translate to financial success. Granted, the demand for real estate continues to rise, and prices have led property seekers to resort to renting as opposed to buying, essentially securing a market of tenants for you. However, according to Lamudi Philippines, renting out property is more than simply owning space, and having someone else pay you as they use it.

It’s a Business After All

The most common pitfall for not-so-successful landlords is how some do not approach property rental as a business. Some treat it more like a hobby where extra income can simply be had, when in order to be really successful, it has to be run like a real company.

Table of Contents

Toggle1. Know Who Your Market Is

Just as tenants vary, so do their needs. While you may want to cater to a particular set, the type of tenants you have still depends on the type of property you have. Naturally, you’ll attract single professionals or small families when what you’re renting out is a condo, and various businesses when what you offer is commercial space.

After narrowing down your market based on the property you offer, make sure you have a keen understanding of what they require from the use of your space. For example, most condo tenants expect to rent a unit, which is at least semi-furnished, so it’s paramount you at least cover the basics in terms of furniture and appliances.

Location, too, will play an important role here. If you’re targeting expat renters, then it makes more sense to choose a condo in Makati or Bonifacio Global City. Properties in these locations are very popular among expats as they’re very close to malls, offices, and leisure areas. If you’re targeting families, however, then you might want to consider a house in gated community or subdivision.

2. Set Aside a Budget

All companies have a budget, so why shouldn’t your rental property business? While you are not necessarily spending for the making and selling of products or for the rendering particular services, the property and its facilities is what you offer to your tenants.

Therefore, it is paramount to establish a budget that is used for the upkeep of your property, as well as an emergency fund should any major repairs become necessary. This way, you avoid prolonging any repair issues that may get worse and ultimately be more costly. You also earn the continued patronage of your tenants, which is quite beneficial in terms of receiving rent in a timely manner and securing referrals for new tenants in the future.

3. Have Everything, as in EVERYTHING, in Writing

Like with any other business agreement, you should have your tenants sign an official lease agreement before they occupy your space for rent. While ironing out the finances and other terms of the lease, you should also look to include all particular rules you’d like to be followed during your tenant’s stay.

The lease agreement must include everything: from the payment terms and lease duration to if you allow pets to also live in the space and if there is a limit to their type and size, specific cleanliness guidelines that need to be adhered to, and when is rent is exactly due and at what point is it considered late, among others.

While it may seem such formalities may be deterrent to some potential tenants, this actually increases the likelihood of you acquiring ideal clients who’ll approach renting your space as professionally as you operate it. Comprehensive contracts also encourage them to follow your rules to the letter, and provide you legal recourse should any of them fail to do so.

Many rental business owners recommend getting a lawyer to draft a lease contract. This eliminates or minimizes the risk of you getting into legal trouble later on.

4. Complete Your Due Diligence

Speaking of ideal tenants, it is paramount that you do your due diligence on who you let occupy your rental space. Getting the wrong type of tenant is probably the biggest mistake a landlord can make, as this increases the possibilities of late rent, damaged property, and even costly evictions.

The process need not be too specific, as what you’d mostly want to do is determine how they could be as your own tenant. Essentially, key information you need to know is if they are employed,had ever been evicted in the recent past, have no recent convictions, and have good landlord references. While it’s not necessary to get specific with the numbers, it’s also recommended to know your tenants do for income to get an idea of their ability to make the rent diligently.

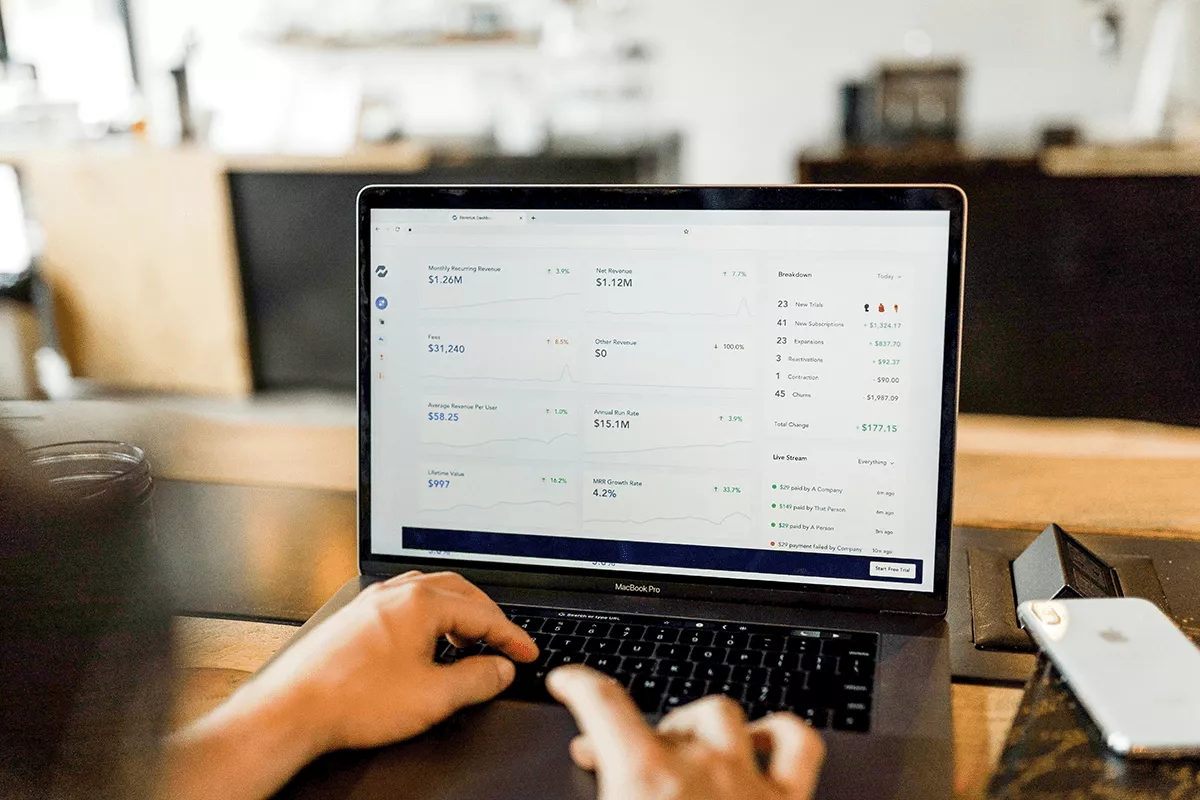

5. Keep Track of Your Cash Flow

What differentiates successful rental businesses from failed ones is that former is able to maintain a healthy cash flow; that is, they made sure that what they’re earning from the monthly rent is more than enough to cover the expenses (taxes, mortgage repayments, upkeep, etc.). A positive cash flow means you’re getting income from the rent after all the expenses have been paid out.

One of the most common mistakes that lead to negative cash flow is underestimate the cost to operate a rental property. For example, regardless of how impeccably built and designed a house is, some tenants will find something wrong with it and will demand for it to be fixed. Many experienced rental property business owners recommend the 25% rule: that is, the total operating expenses for rental properties should not exceed 25% of the total gross rental income received.

6. Fulfill Your Duties and Obligations as Landlord or Property Owner

The best way to get your tenants to meet their obligations related to the use of your property is to make sure you fulfill all of yours as the landlord/owner. Remember, your rental space should be treated as a full-pledged business, and as such you are legally obligated to deliver on the terms and conditions that are in the agreement that you reached with your tenant.

Apart from delivering what is needed yourself, this also means being smart enough to know that sometimes professional help is needed. For example, if the electrical system of your space or building is malfunctioning, it is indeed your responsibility to have it fixed, but not to do it yourself. You immediately enlist the services of an expert, which has you effectively addressing what is needed quickly and effectively, while also ensuring all occupants’ safety.

Also often overlooked (or neglected) especially by owners of rental condos is securing the necessary business permit and official receipts from the Bureau of Internal Revenue (BIR). Remember, a rental property is a business and you as the owner must issue a receipt, especially if your property is rented out to corporate clients.

Braulio Giron Jr. is a Content Writer for Lamudi, the Philippines' largest and fastest growing online real estate platform. Braulio also writes for Myproperty.ph, a recently acquired company by Lamudi and the blog The Pinoy Fighter, which publishes latest news about the local mixed martial arts scene.